If you’ve been following the series, you have a general baseline on how going digital can improve your overall business functions, but how can you gauge how well your investment is operating?

The answer: Digital Analytics!

The success of your digital strategy depends almost entirely on your implementation of meaningful digital analytics. They allow you to gauge your success and shortcomings, so you can allocate effort and resources where they’re needed.

Why hinge your organization’s success on assumptions, when you can base your decisions off of facts?

This second series will discuss the various stages of digital analytics implementation, as well as key questions that should be considered to optimize their use.

Stages of Implementing Digital Analytics

Understanding and getting ahead in analytics does not solely mean focussing on your website analytics. Although, you should definitely pay attention to your Google Analytics and optimise for increasing conversion.

In order to go fully digital, using analytics effectively means making the call to gather data from your entire range of channels, including website conversions, social media, online advertising, contract turnaround times, and contact data.

Stage 1: The Basics

When you begin implementing digital analytics, you should first focus on building a strong foundation analytics. Start by mapping out your operations process, from lead to customer. Break apart the process by identifying crucial touchpoints, for example, those touchpoints could be when a lead enters your sales funnel (Lead) and when the lead converts to a paying customer (Customer). From here you’ll have to start measuring the time taken for the actual conversion and assign it to the corresponding touchpoint.

Keeping track of these touchpoints and analysing the data regularly allows you to understand your operational flow and identify sectors or departments that require optimisation.

Stage 2: Lay the Groundwork

Once you have identified key touchpoints, now it’s time to begin tagging all of your pages, to obtain baseline information on how your users interact with each page. For example, you can see which of your pages are the most popular. Tools like Google Analytics and Mix Panel can help during the tagging process, by checking and alerting you about broken tags- so you never unintentionally neglect data! Keep in mind, solely using web analytics is not enough. The majority of the data you receive is descriptive and does not give you any actionable or meaningful insight. The ultimate goal is to build your web analytic strategy into a fully digital strategy. In doing so, the data you collect will be more useful, more in-depth, and can better guide your decision making. Instead of just knowing which pages are popular, you will be able to understand why. And, in turn, how to improve the pages that are not!

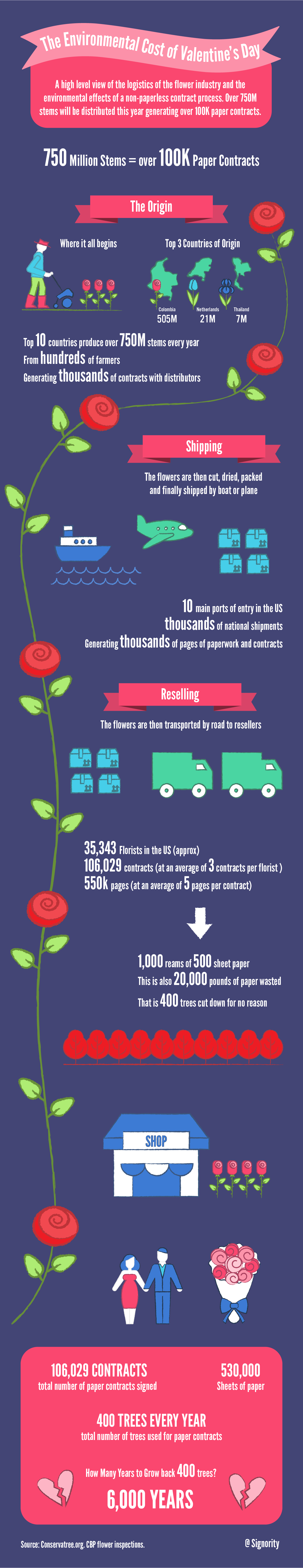

The most successful insurance businesses are fully aware that information is the lifeblood of the industry. Knowing when and how long a lead turns into a customer is absolutely crucial to understand bottlenecks in your sales process. You can start this process by moving from paper to a digital signature solution. This allows you to see the time it takes for a contract to be signed (I.e. Lead to Customer) in real time, streamline the process for your customer, and also give you an overarching look into your sales funnel.

Read how you can go paperless here.

Stage 3: Analytics Pro

Congratulations, you’ve almost made it to the finish line! It’s time to integrate multi-channel and multi-touch digital analytics across all your business platforms. In order for you to completely personalize and optimize your customer interactions, it is imperative that you fully understand their buying patterns/behaviours and preferences. As such, there should be a strong emphasis on customer and user analytics. Moreover, digital analytics provide predictive data. Meaning, you can better understand and foresee new customer trends, behaviours, and anticipate future outcomes, optimizing your efforts. IBM’s Digital Analytics provide advanced analytics by tracking visitor behaviour over time, and across multiple touchpoints and channels. This tool can also compare your success with competitors, and give recommendations when warranted.

Before Going Digital: What’s Your Plan?

EY, a global leader in tax and advisory services, recently asked insurance firms some thought provoking questions:

- Are you rolling out analytics in tandem with digital?

- Do you have the right capabilities in place- — a strong analytics team & supporting tools?

- Are you capturing, storing and using current customer data to maximum value?

Before implementing digital analytics, you should have a general idea of how to approach each question. Since there’s no better time than the present, let’s get started:

Measure Your ROI With Digital Analytics

By 2019, global investments for digital transformations will amount to $2.1 trillion– with 70% of these initiatives predicted to fail! With this in mind, less than 15% of companies can quantify their digital initiatives ROI with traditional methods. It is more imperative than ever to start using digital analytics to gauge your investments ROI. You can see where you’re making money, cutting costs or, brace yourself… where you’re losing money. In essence, you can clearly see what’s working, and what isn’t, and how well your investment is paying off. As such, you can make improvements where necessary, and hold relevant people accountable. Some analytics you may want to track include: conversion rates, customer satisfaction, reduction in time costs, percent of revenue coming directly from digital channels, and percent of revenue enabled from digital channels.

Build Strong Digital Analytic Teams & Supporting Tools

You’re only as strong as your weakest link, so don’t limit your strategy’s potential with poor teams or supporting tools.

People

The entire organization must be on board and supportive of the digital shift. Your organization’s culture must transform toward a digital-centric and customer-focused model. Aside from the obvious need for technical skills, the analytics team must have a deep understanding of your organizational goals, and of customer wants and needs. Only then can they properly leverage and interpret the data in a way that’s meaningful towards future success. Moreover, they may be the only employees who realize potential opportunities and weaknesses. In order for them to relay the results in a clear and effective way, they must have strong communication skills.

Tools

There are various tools you can use to support your overall analytical process. First off, Matplotlib can help with data visualization, which would otherwise be time-consuming and tedious to create. Smart panda labs can help your team maximize its use of Optimizely. Smart Panda Labs help implement, personalize, troubleshoot, analyze results, and even provide recommendations accordingly.

Maximize Value by Using Quality Customer Data

Your results are only as good as your data. Currently, insurers are not taking advantage of the full potential of digital support. In fact, insurers rate themselves less than 2 out of 5, for overall customer experience. They are failing to communicate with customers during critical points in their buying process, and, consequently, missing out on huge opportunities. By using quality customer data, insurers can better understand their customers and properly communicate during all steps of the buying process. Accurate customer data allows you to better target your customers, decreasing costs and increasing conversion rates. Moreover, capturing, storing and utilizing current customer data gives deeper insights into the buying habits of your customers, giving you more accurate predictions of future behaviour. Unsurprisingly, according to McKinsey & Company, companies that effectively use customer analytics are more likely to outperform their competitors on key performance metrics, including profit, sales, sales growth, and ROI! In fact, with the use of customer analytics, profit and ROI almost double.

All in all, digital analytics are essential to fully maximize your digital transformation. They give you an in-depth understanding of what’s working, what’s not, and how to improve. Why do it the hard way when you don’t have to?

Like the saying goes, “assumption is the mother of all mistakes”.

Miss Part 1? Don’t worry, you can read more about how going digital can save you time, money and effort all while improving your customer’s experience from our previous post in the series!

Looking to go digital? Sign-up now and get 14-day free trial on one of Signority’s plans!

The author Katie is the Marketing and Communications Manager at

The author Katie is the Marketing and Communications Manager at