eSignatures have been around for over two decades, but many businesses have yet to make the switch from paper signatures to electronic ones. One of the main concerns is that eSignatures lack the security necessary to ensure that the document’s contents are kept confidential and the signatures coming back are legally valid. Let’s see if this is true by doing a side-by-side comparison of paper signatures and electronic signatures.

Wet Signatures

Physical or “wet” signatures are the traditional pen-and-paper signatures that are physically applied to a document. For these types of signature, the document to be signed may be sent to the signer via mail or other method to be signed privately. At other times, the document is signed in the presence of one or more other people. Paper signatures are a physical representation of a person’s identity and serve as proof of their consent to and acknowledgement of the contents laid out in the document. More often than not, a paper signature’s validity is based on trust. As the person who requested the signature, you must trust that the person who signed the document is who they say they are. As a signer, you must trust that your signature is not being forged to sign documents without your consent. Since wet signatures don’t come with a report that tells you what happened to a document prior and during signing, there is no way to directly trace the signature back to where and by whom it was signed.

In addition, with wet signatures, if the documents are not scanned and uploaded to the cloud, there is a risk of a natural disaster occurring and destroying the contents. This is another risk that businesses must face if they opt to continue to sign papers using paper.

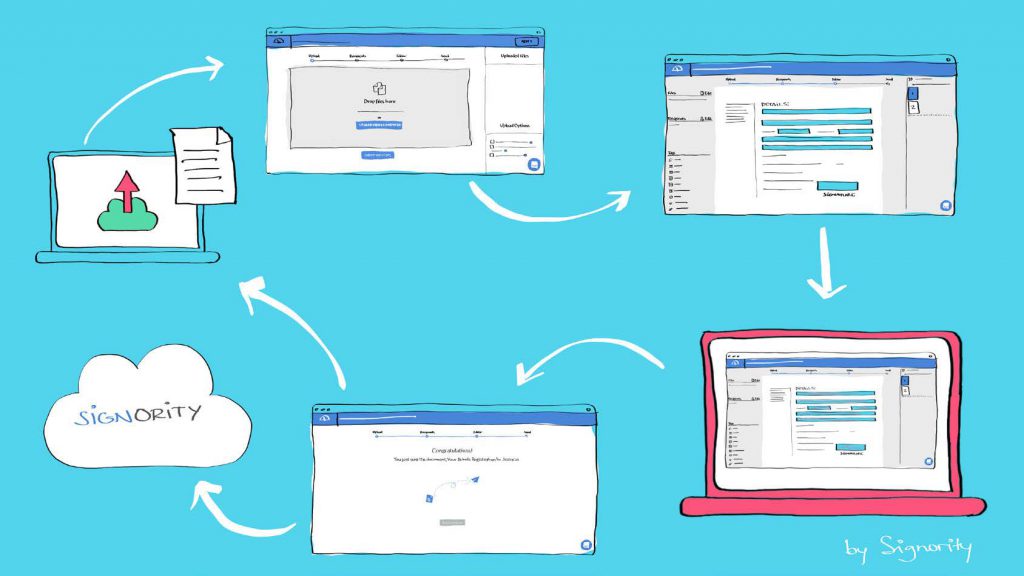

eSignatures

An eSignature is an electronic piece of data that is created by an individual. The application of this piece of data to a document represents the signer’s identity and consent to and acknowledgement of the contents in the document. It serves the same function as a wet signature. However, since all the signing activity is done in the cloud, eSignature applications can track and observe a signer’s actions during signing. Signority’s eSignature solution tracks the name, email address, IP address, and time of date of every action performed by the signer during signing. This allows document senders to have a full traceability report for each of the documents they get signed. Compared to wet signatures, this makes verifying a signer much easier, and can save businesses legal headaches down the line. For a signer, as long as you have full ownership over your email address, only you will have access to the documents you should be signing. If someone does try to impersonate you and eSigns a document without your consent, all their activity will be logged through the document’s audit trail. This information can be used to show who really signed the document. Furthermore, the use of SMS 2-factor authentication, and other authentication methods helps ensure the identity of the signer.

In terms of document storage, digitally stored documents are backed up in the cloud, so in case of a disaster, you won’t lose your documents. In addition, almost all eSignature providers have industry best-practice security certifications such as SOC I and SOC II certification and ISO 27001:2013 certification. These certifications verify that the company handles their customer data securely, protecting it from outside attackers, and can effectively recover from incidents that would otherwise lead to loss of data.

Finally, documents signed with eSignatures often come with a digital signature applied to the document by the eSignature provider. This digital signature can act as a type of tamper-proofing mechanism to detect whether or not a document has been tampered with. You can learn more about what digital signatures are here.

With all this information, it’s clear that eSignatures are a good choice for many companies. They provide superior security and traceability for signed documents. Not to mention they also cut down on the time you spend on each document that needs to be signed!