In financial podcast episode 16, Darlene interviews the CEO of Signority, Jane He.

“Financial podcast” was created and developed by Customplan Financial Advisors Inc. to promote financial literacy in Canada. They interview professionals from various fields on topics that matter to you. Jane was invited to talk about e-signatures in Canada in their 16th episode.

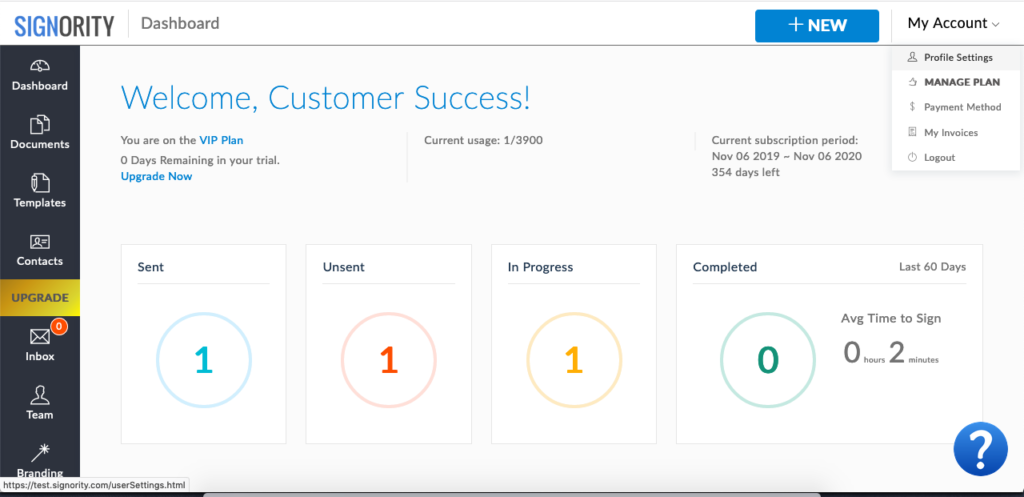

Jane has been in the hi-tech industry for 25 years, and In 2010, she started Signority. The company made many several significant milestones: in 2016, the Department of National Defense of Canada successfully deployed that platform through the federal government innovation program, and, for the first time in history, Signority helped the Government of Canada eSign the first MoU with the Government of Great Britain.

In the podcast, Jane states that “in the legal definition, a signature is your intent to consent to an agreement. As long as it proofs your intent, a dot, a line or any other format is a legal signature.” She adds that signatures may not be easily legible as people tend to add their own styles and personalities, but as long as they are authentic, they are legal. Then she states that “in the digital world, we have the technology not only captures the handwriting signature, but also captures IDs, when, and where a person signs a document. These data serve as court evidence and legal proofs.”

Although she admits that it can be hard to prove a simple signature without evidence, we can solve this problem with the concept electronic signature, secure electronic signature/digital signature and the signature workflow to meet legal requirements. Those legal requirements are stated in the PIPEDA (The Personal Information Protection and Electronic Documents Act):

- the electronic signature must be unique to the person using it;

- the person whose electronic signature is on the document must have control of the use of the technology to attach the signature;

- the technology must be used to identify the person using the electronic signature; and

- the electronic signature must be linked to an electronic document to determine if the document has been changed after the electronic signature was attached to it.

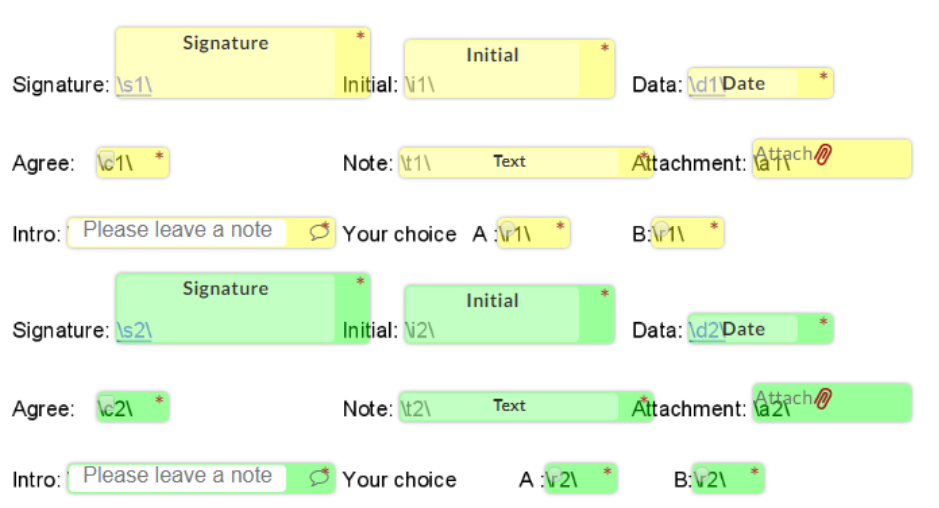

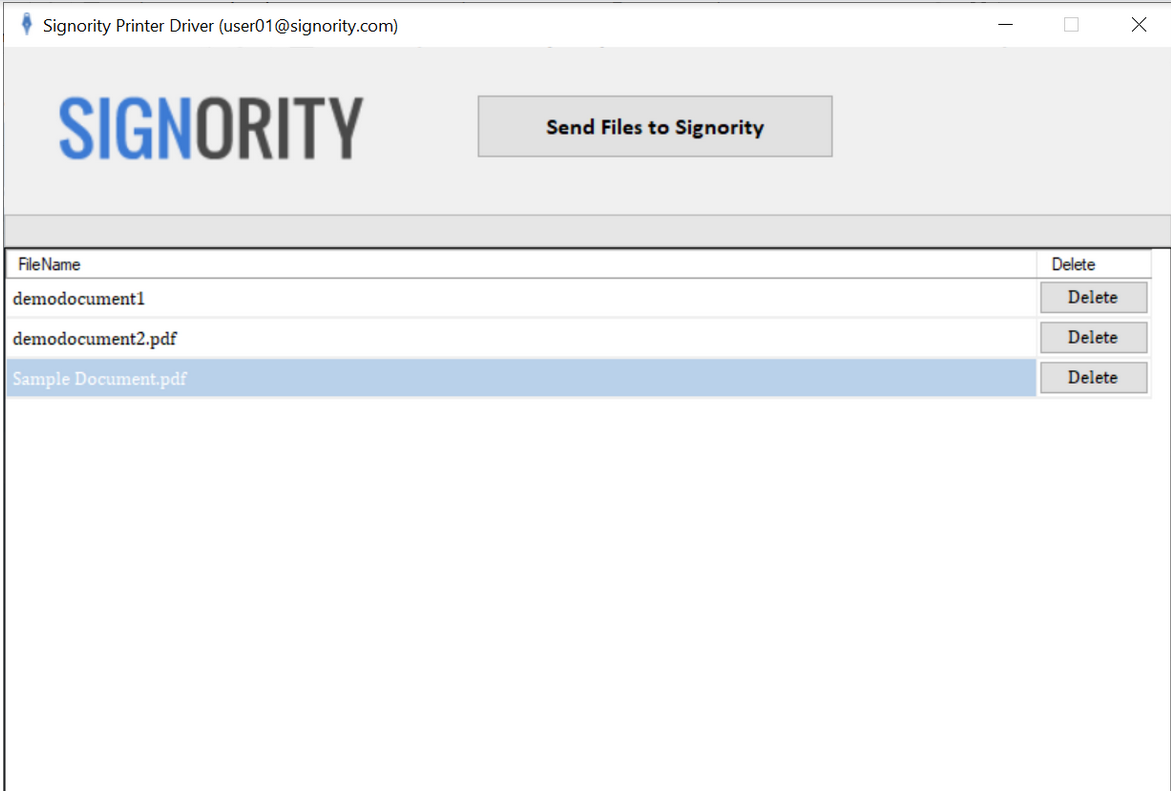

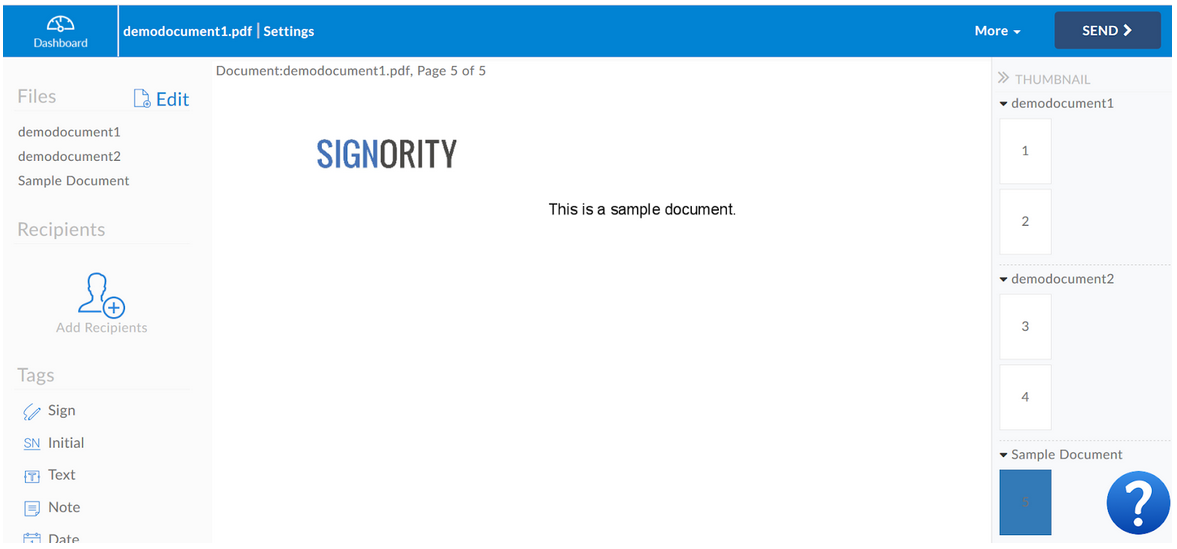

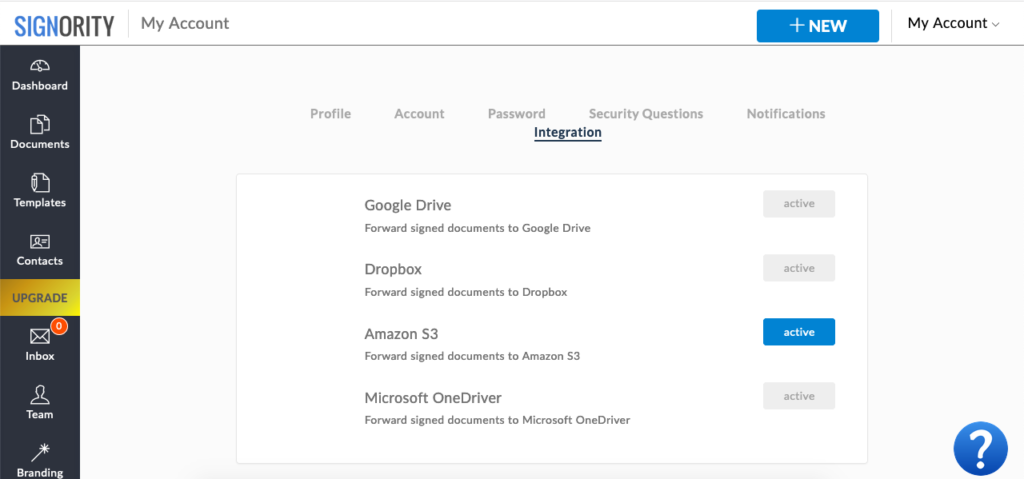

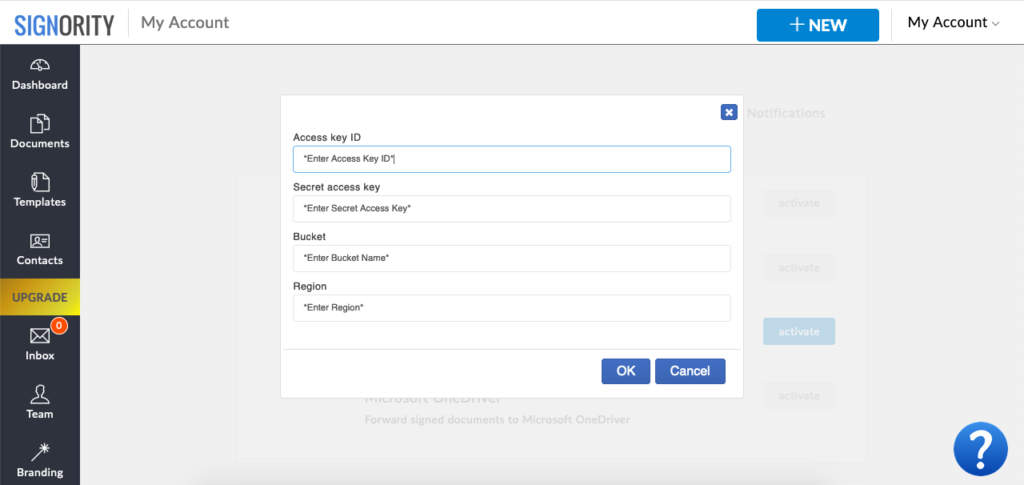

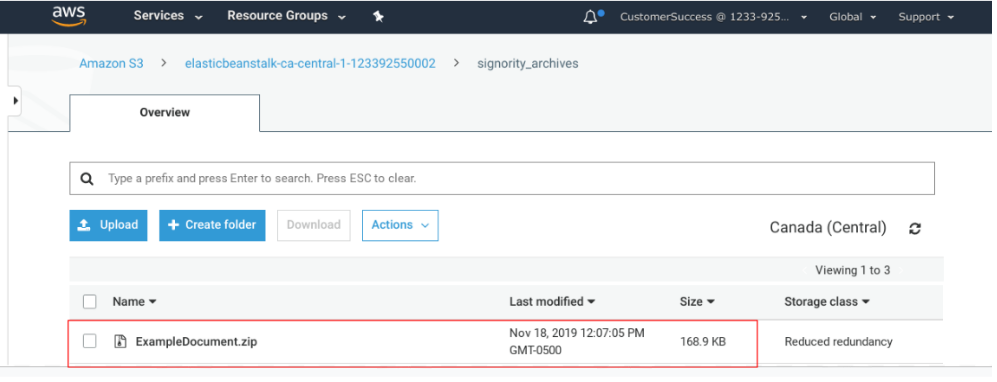

Signority’s many features such as multi-factor authentication, and digital seals ensure that these requirements are met. Jane sees eSignature technology as a process; like a signature ceremony rather than scribbling your name on a digital document.

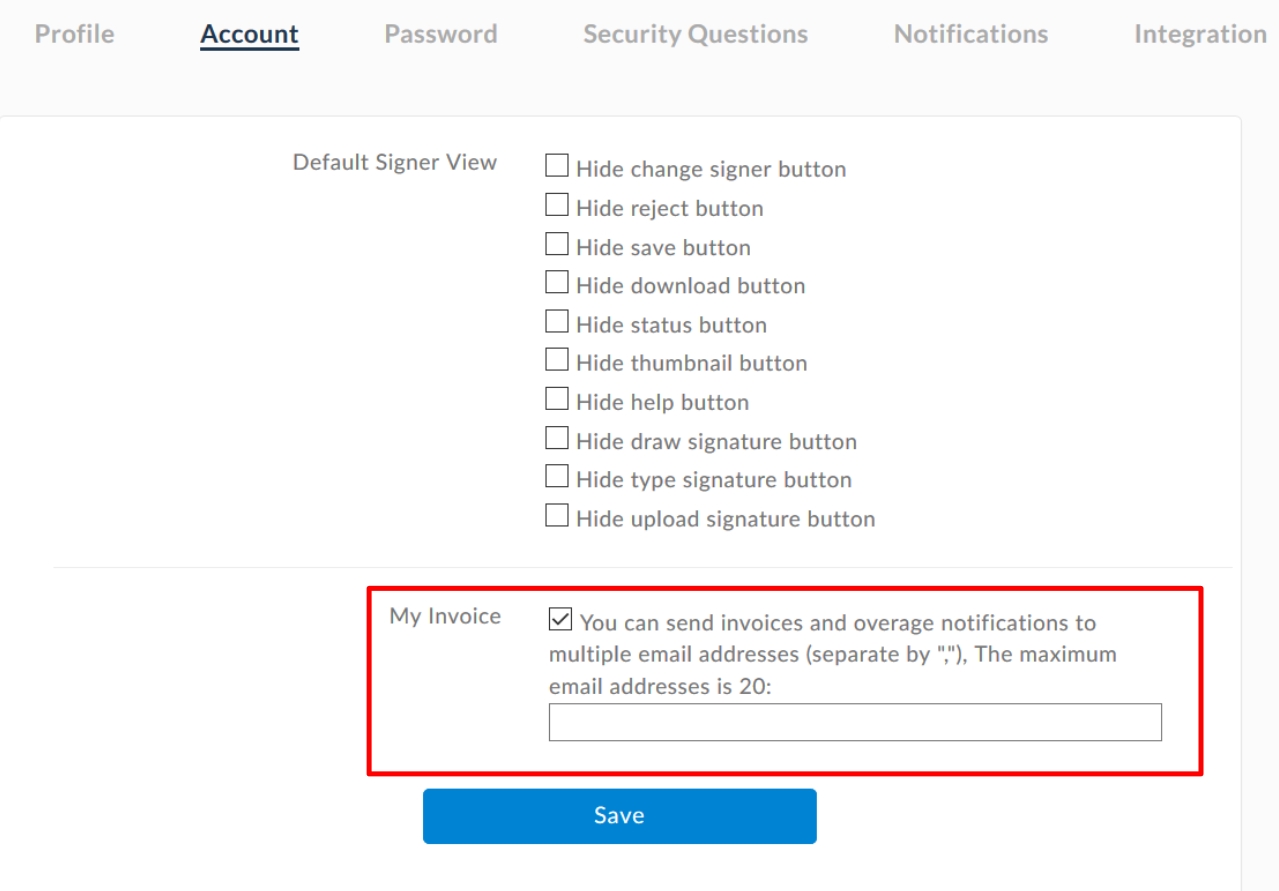

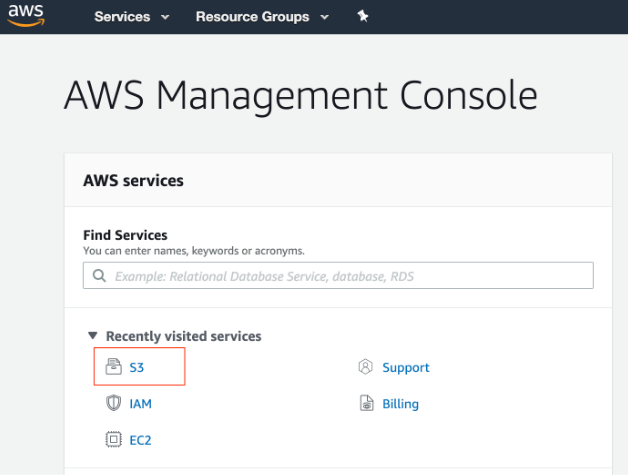

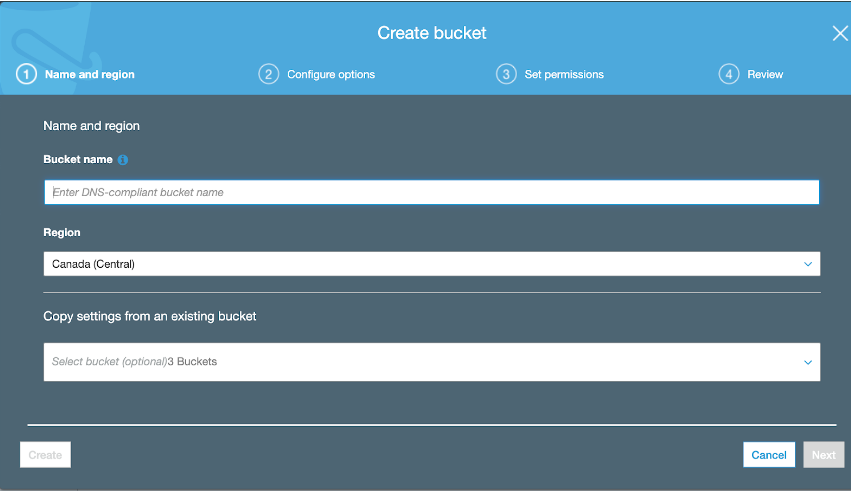

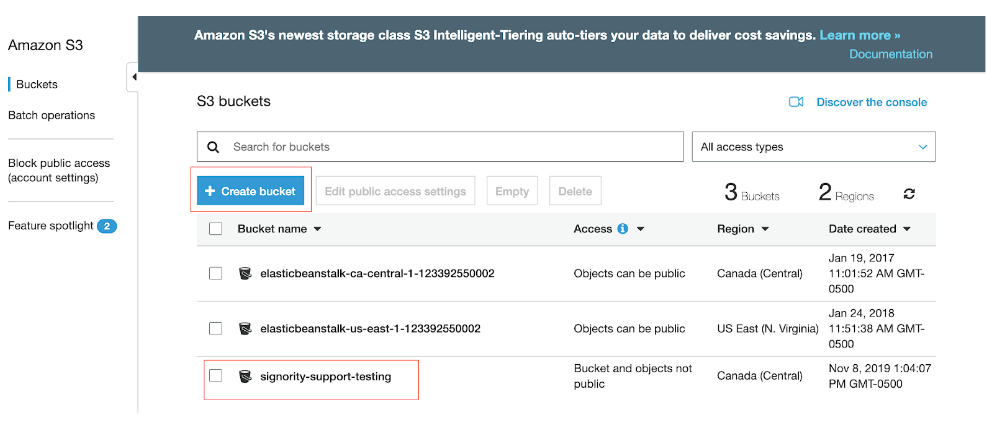

When asked about security, Jane assured that all documents signed using Signority are secure. Signority has the Canadian government security clearance. She states that there is a security officer and privacy officer at Signority, that policies are reviewed by their lawyer periodically, and that they have established a privacy breach protocol.

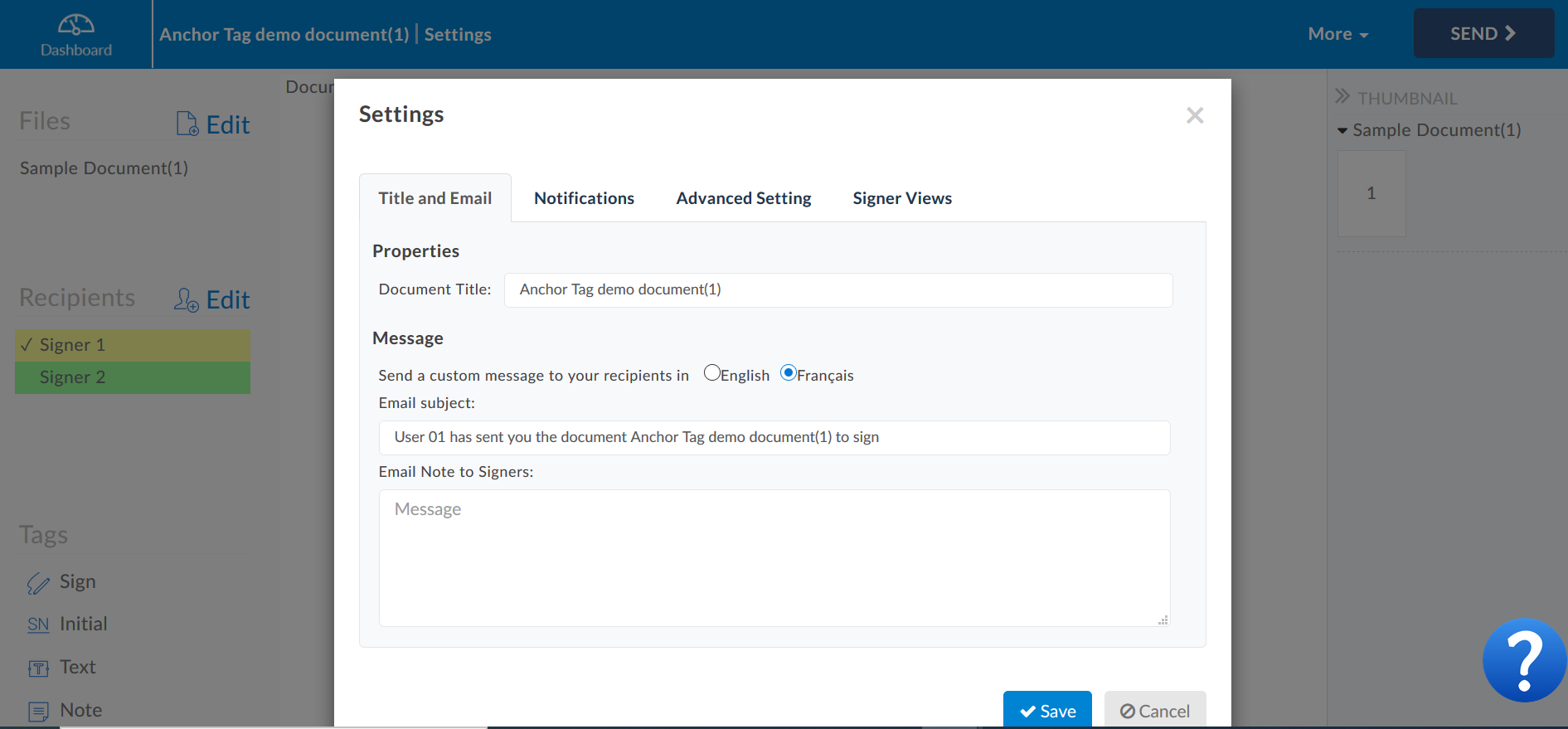

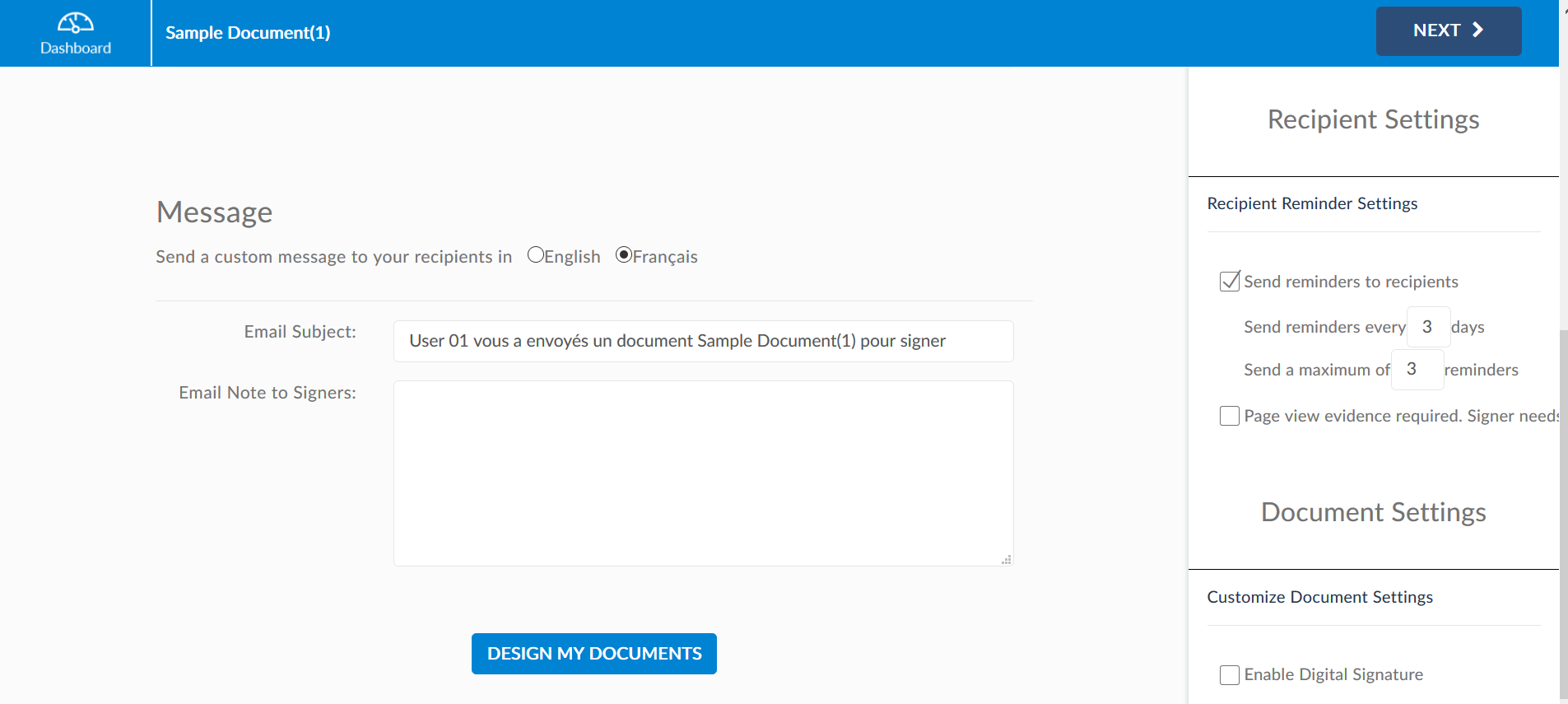

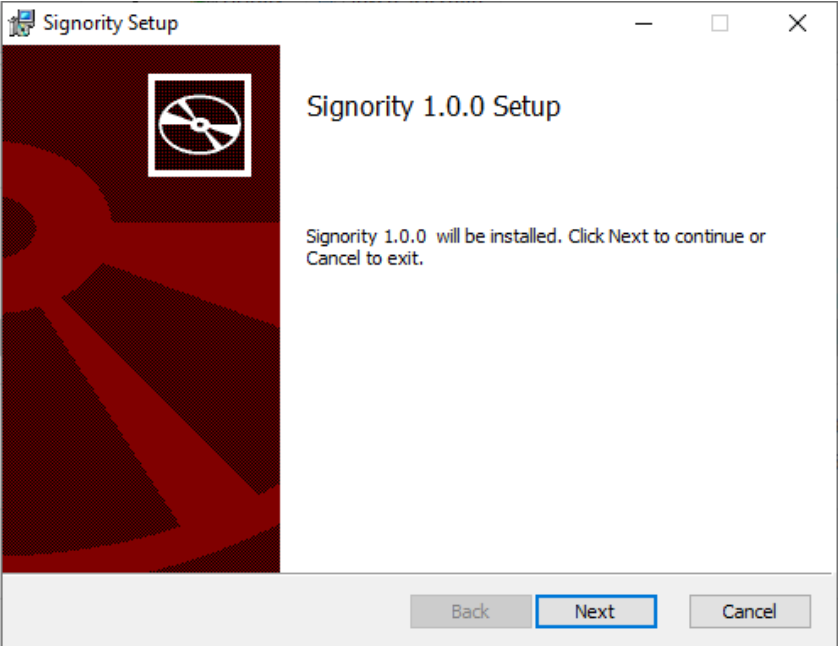

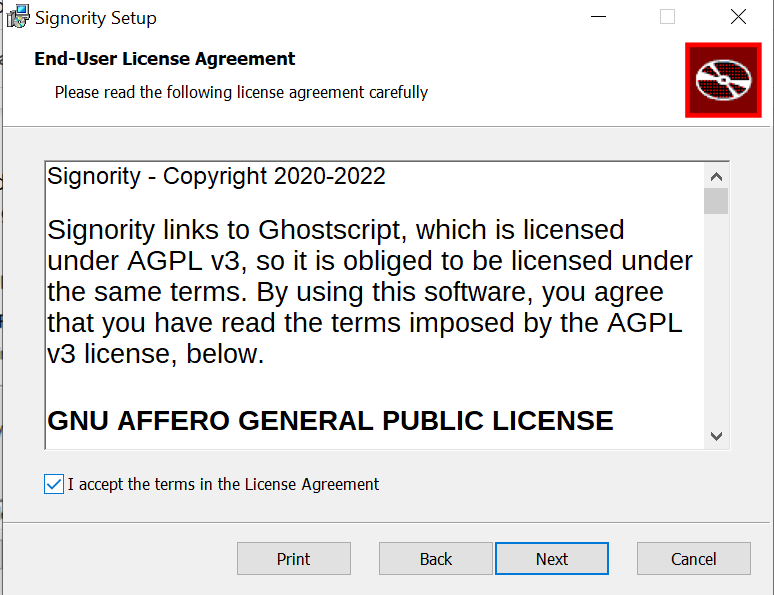

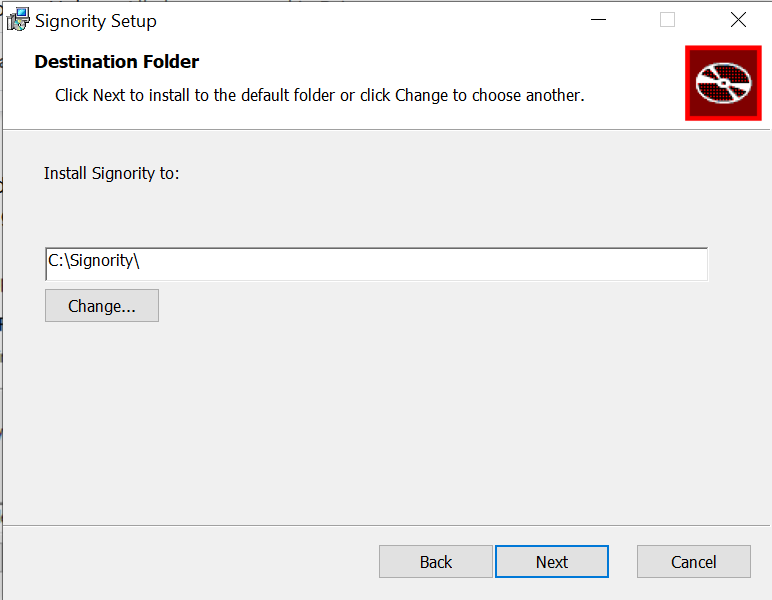

Signority is not only secure, but as Jane details in the podcast, anyone with access to a browser can use Signority. In the signing process, there is no special software or equipment required.

She also highlights that eSignatures can be used in all sectors; it’s also suggested to talk to your lawyers before you use it and also check your industry’s regulation and by-law besides federal and provincial acts. Signority has been serving insurance and banking companies for several years, and is proud that CSIO, Canada’s industry association of property and casualty insurers has selected Signority as its eSignature provider since 2015. For individuals, the CRA has given the green light for Canadians to file personal and corporation income tax by eSignature for the first time in history, largely due to the pandemic.

If you would like to listen to the podcast yourself, click on the link below!