With the explosion of technology and rapid increase in online spending, a completely digital future is inevitable. In this series, we aim to answer key questions, examine various business and technology trends in the insurance industry, and breakdown critical statistics to help you take your business digital.

In the first of this series, we discuss key questions that you need to consider before going digital.

Going digital with your insurance business and what you need to consider

Why does it seem like the insurance industry is stuck in the Stone Age?

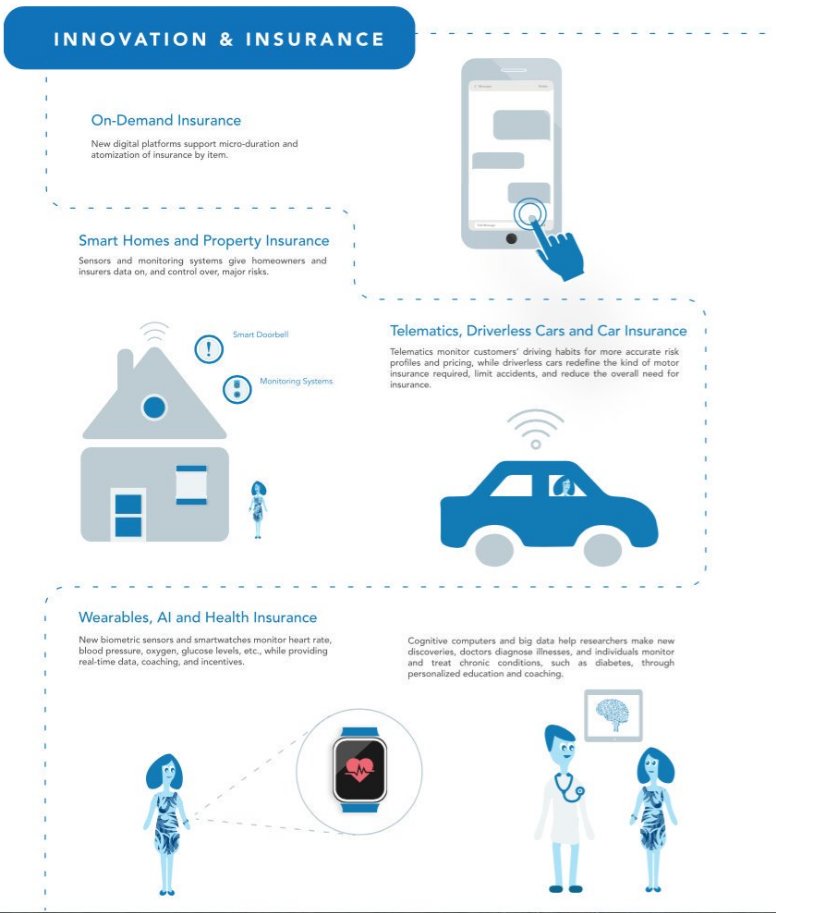

With 40% of the world online, and more than 4 billion people connecting to the Internet every day, the future is undoubtedly digital. Consumers are already embracing the digital age, and expect companies to follow suit. In fact, before purchasing insurance 71% of consumers use some form of digital research to learn more about their options, and scope out company’s online presence. Research also shows that digitalizing your company can improve conversion rates by 20%, decrease cost reduction by 65% and shorten insurance processes by 90%. Unsurprisingly, there is a direct correlation between positive future growth and an implementation of technology.

Considering 79% of insurance firms believe they are behind the digital times, there is a huge opportunity for you to gain competitive advantage. Plus, going digital doesn’t have to break the bank.

Let’s start with the fun stuff and go over how dropping paper or going digital can help your organization save money:

Paper Vs. Digital Documents

Paper documents are more expensive, less efficient and less secure than digital. Unsurprisingly, without the use of paper, your office will drastically reduce the need for ink, printers, and, drum roll please… paper! If these seem like small expenses to you, the average employee goes through 10,000 sheets of paper per year, amounting to a whopping $80 per employee. With these eye-opening numbers in mind, 47% of managers agree that the cost of paper is a major negative, with 61% saying they would welcome going fully digital. Paper is also less secure, as it can easily be forged, damaged and lost. According to GRM, 15% of all papers handled by individual businesses were lost, and it cost around $120 per company in labour to find them (and $220 to finally replace them). Is it really that hard to believe that paper would also be less efficient? Paper takes time to write (and find), print, send, and takes up space in the office, prolonging the entire process.

Going digital saves you time, money, effort and gives your important documents the protection they need. With digital documents, you are able to streamline distribution, sharing, information, tracking, and editing. Added bonus, no cluttered overfilled storage cabinets! All your files will be online, which you can access from anywhere, anytime. Leaving your employees with more time to do the important things, like attracting new clients and building stronger relationships with existing ones.

Before Going Digital: What’s Your Plan?

EY, a global leader in tax and advisory services, recently asked insurance firms some thought provoking questions:

- Have you identified preferred platforms that align with a digital strategy?

- Can your operating model quickly detect and respond to shifting customer demand in digital space? If not, how can you develop this?

Before going digital, you should have an answer to the above questions. This may take some time, so let’s get started:

Preferred Platforms that Align with a Digital Strategy

Going digital may seem like an uphill climb, but there are plenty of resources out there to make things easier. These resources can help you at every step of the way, including your customer engagement, your customer onboarding, and your digital marketing strategy.

Nowadays, customers need and expect, a channel to openly communicate with companies. Customer engagement builds trust and positively increases your company’s reputation. As such, you are able to attract new customers, build stronger meaningful relationships with existing ones and better personalize your content in the future. Therefore, you can better upsell and cross-sell to prospective clients. Moreover, customers research different policies and options before deciding, and they want to have the ability to easily communicate with a company representative to answer any questions they might have. Unsurprisingly, Gallup found that fully engaged customers are more loyal, and more profitable than the average customer. Increasing customer loyalty is especially important for insurance companies, as their average rate of retention is 10% lower than that of any other industry. Considering it can cost up to 10 times more to acquire a new customer than it does to keep an already existing one, this is a huge loss of profits. Luckily, there are tons of available tools that can help you. The company Aspire focuses its efforts on CRM and offers customer SMS messaging, social media integration and personalized reminders (so you’ll never miss a chance to wish your client a happy birthday!).

You should always prioritize customer experience. With the amount of freedom and choice, the average customer has, successful customer onboarding is increasingly important. Nearly 9 out of 10 customers say they would pay more to ensure a superior customer experience. Successful onboarding leads to a smooth and positive customer experience throughout their entire journey. As such, this generates customer loyalty, meaningful customer relationships, and generates more leads. Companies like Accenture allow you to reach your full potential and give customers the experience they want and expect. This service can help you create differentiated and compelling user experiences that increase engagement while lowering your transaction costs.

If you haven’t at least started to implement a digital marketing strategy, you are greatly missing out. Digital marketing allows you to reach specific target segments, expand your reach, and easily monitor your results. Through this, you can increase conversion rates, decrease cost per leads and build a positive brand reputation.

Oh, and did I mention you can do all of this, and save money?

A staggering 40% of small- to medium-sized businesses admitted to saving considerably by using digital marketing instead of traditional methods. Digital marketing also levels the playing field for small to medium sized businesses, allowing you to compete against the big guys. If that doesn’t convince you, let me throw in some numbers. It has been shown that companies who utilize a digital marketing strategy have 2.8 times higher revenue growth than those who do not, and, specifically, small to medium sized businesses have 3.3 times higher overall business growth rates. Companies like Applied can help implement your digital marketing strategy, by using simple digital marketing tools to not only increase your brand awareness but also to build a stronger brand reputation. This is done by helping you build professional websites, interact with customers, and use banner ads to upsell and cross-sell your products.

Digital Friendly Operating Model

You probably know by now, that digitizing your brokerage’s operation models can a significant, positive impact on your profit margins. Let’s take a look at some average day to day activities, and see how digitalizing your company can improve them:

1. Paperwork

Ahh paperwork, everyone’s favourite past time… perhaps, in an alternative universe.

But in this one, paperwork can be tedious, mundane, and frankly, can waste a lot of your precious time. Stop living in the past, and take advantage of one of the biggest trends to hit the insurance industry, eSignatures. eSignature companies, like Signority, offer a wide range of services that allow you and your business to fully transform into a paperless office. Digital documents enable you to quickly send contracts to customers, bypass time delays (like scanning or mailing) and send reminders to customers to sign. Additionally, you will no longer have to waste time analyzing forms to make sure all the required fields are filled in, let the software do it for you! You can also save time by building standard document templates, and by organizing all of your files in one central location. On the customer end, they will have the ability to complete forms from any location, and on any device.

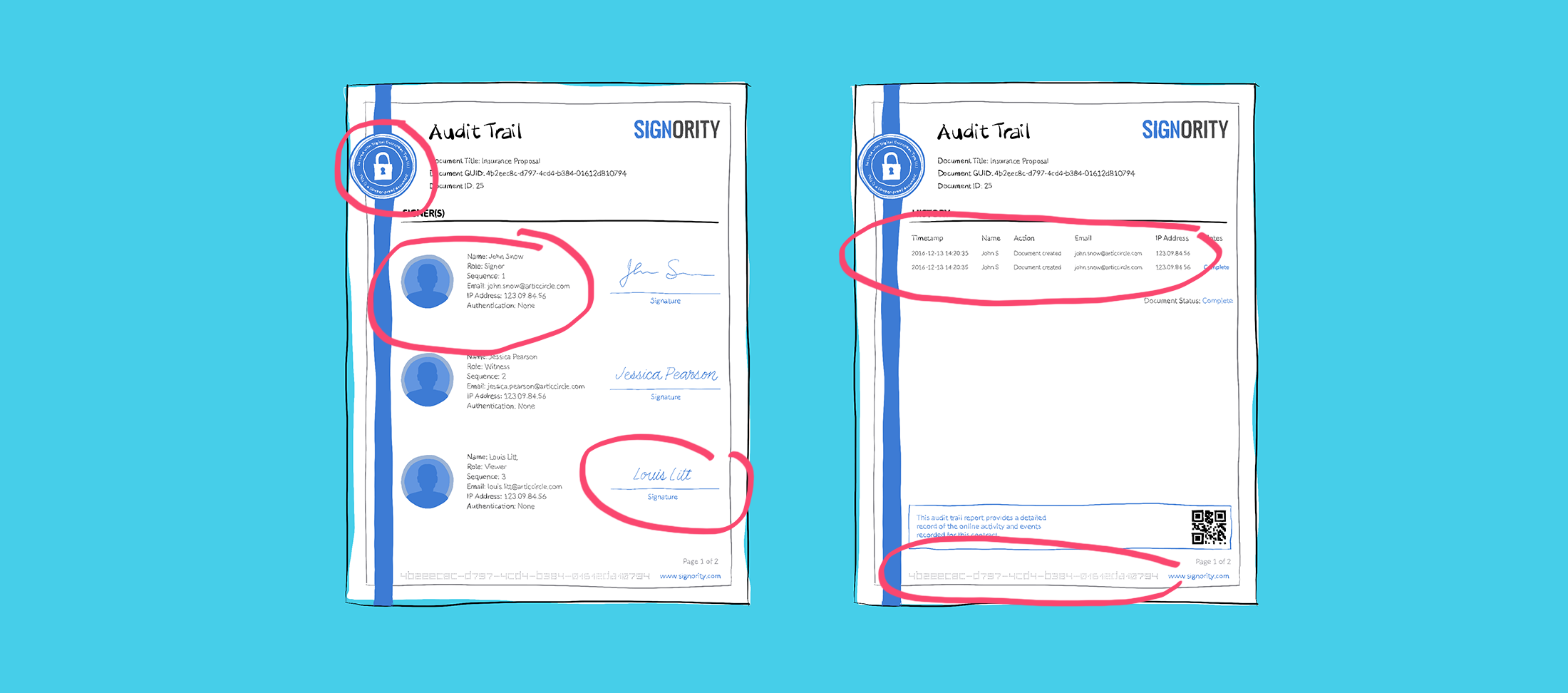

As mentioned previously, experts agree online document services can be more secure than old-fashioned hard copies. Signority provides a detailed tamper-proof audit trail, that lets you know where, when and how your document is being used. You also have access to timestamps, user IDs and Ip addresses. Moreover, you can safely store all of your documents in the cloud, keeping them out of harm’s way (and ensuring they won’t be misplaced).

2. Communicate with Underwriting Team

As you may know, internal communication is extremely important. Since communicating with the underwriting team is probably a major part of your job, utilize digital technology and work smarter, not harder. Online communication tools like Slack can make your communication process as smooth and quick as possible. Slack allows you to organize conversations in channels, send direct messages, and even make calls. You can also drop and share any and all file types, and quickly search for important messages through your archives. Slack can be downloaded, and synced, on any platform (mobile, desktop, etc.). Through this, you can drastically shorten the communication process with your underwriting team, saving you time and effort.

3. Communicate with Current Customers

According to Ryan Hanley, a prominent digital marketer — new insurance buyers want better digital communication and interaction. By going digital, you can open up a streamlined 24/7 communication line with your customers. This can increase customer satisfaction, resulting in long-lasting relationships, which, in turn, can create customer brand ambassadors. You can also implement an automated selling engine, enabling customers to build their own insurance policy, saving you precious time. Automated notification lists can also be implemented. For example, you can notify customers when their policies are expiring. Through this, you can increase your re-purchase rate and speed up the buying process. Clients can also digitize their claims. For example, when a client has been in an accident they can file a claim directly at the scene, speeding up the whole process.

4. Attract New Customers

A vital part of your job is to attract new customers; by digitalizing your process, you are able to connect with new customers farther and faster. Moreover, with the use of digital signature solutions, completing contracts is 80% faster; so you can register new clients faster! There are also ample opportunities for you to create innovative features to attract new customers. As explained by Harvard Business Review, Progressive has made buying insurance easier, by allowing potential customers to send photo’s of their driver’s license to generate quotes for their auto insurance.

Don’t be scared of change, embrace it! Going digital can save you and your company time, money, effort, and stress, all while improving your customer’s experience. Welcome all these new opportunities, go digital!

Your biggest challenge will be to figure out what to do with all your excess paper. My suggestion? After your profits skyrocket, throw a celebratory bonfire (using the paper as kindling, of course).

Looking to go digital? Sign-up now and get a 14-day free trial to a Signority eSignature Plan.